Imagine spending thousands of dollars on customer acquisition campaigns for your business, only to get a fine from your regulator for onboarding a fraudulent customer, whose identity was not properly verified. This happens to many businesses across the world and it is why we need KYC (Know Your Customer). KYC helps build trust in all transactions by verifying customer identities, saving you costs in regulatory infractions and improving customer acquisition.

From gaming platforms to financial services, telecoms, and online marketplaces, KYC goes beyond simply collecting self-reported information. It aims to establish a verified identity for every individual, helping to build trust and reduce risk.

Security vs. Speed: Balancing KYC with Customer Experience

Unlike buying a quick cup of coffee, KYC involves collecting and verifying information which may or may not be done in real time. This can be a hassle for today’s customers who value speed! They can get frustrated, leading them to seek a smoother experience elsewhere, perhaps with your competitors. So, some businesses neglect KYC in order to onboard customers quickly. This often comes with consequences.

In 2017, Deutsche Bank was fined 163 million pounds for failing to obtain sufficient customer information and conduct proper risk assessments. Mark Steward, the Director of Enforcement and Market Oversight at the FCA at the time, said: “Deutsche Bank was obliged to establish and maintain an effective AML control framework. By failing to do so, Deutsche Bank put itself at risk of being used to facilitate financial crime and exposed the UK to the risk of financial crime.”

The Nigerian telecommunications industry offers another example. Initially, SIM card sales were swift, taking about 30 seconds. However, a lack of verification led to criminal activity like kidnapping and money laundering, forcing regulators to implement stricter KYC measures. Unfortunately, this system was easily bypassed with fake IDs, which resulted in hefty fines for some major operators.

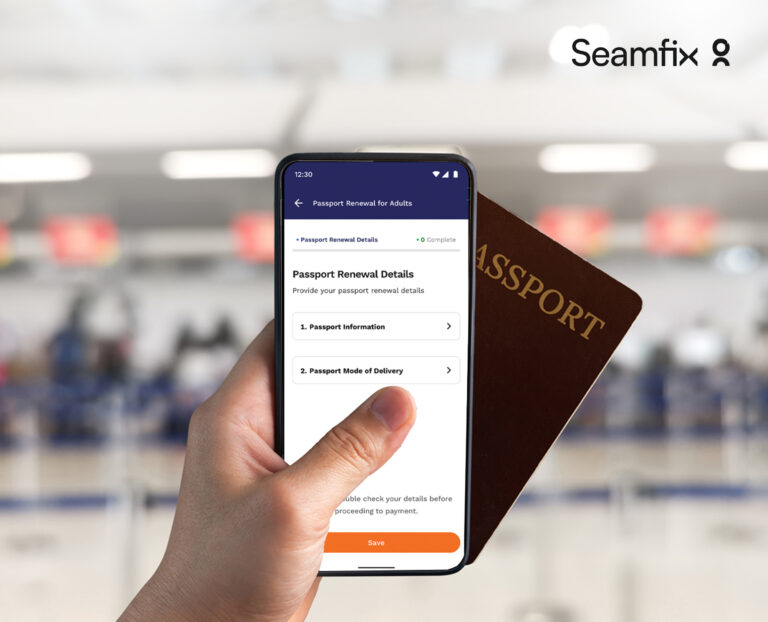

To fight fraud and reduce onboarding times, telcos implemented real-time name checks, liveness scans (verifying the user behind the device), and advanced document verification. MTN, for example, implemented Seamfix’s KYC solution suite, which captured subscriber details (textual, fingerprints, and portrait) and processed millions of SIM registrations weekly, reaching a peak of over 600,000 registrations daily..

These case studies highlight the ongoing challenge of balancing robust KYC and quick customer onboarding. Long waits can push customers away so businesses need seamless KYC to reduce wait times and prevent drop-offs without compromising security.

Security and Swift Customer Onboarding, What is The Way Forward?

New regulatory requirements as well as more sophistication from malicious actors emphasize the need for strong KYC to fight financial crime. However, businesses must also prioritize a smooth customer experience to avoid abandoned carts.

Here’s how to achieve this balance:

- Implement Risk-Based KYC

Collect more information for larger transactions (classified as high risk) while streamlining the process for smaller transactions (classified as lower risk).

- Seamless Integration

Don’t disrupt the customer journey flow by asking for a lot of information upfront. Consider collecting KYC details further along the journey or as usage increases.

- Advanced Technologies

Use advanced solutions, such as contactless fingerprint capture to accelerate onboarding while maintaining robust security. This is a solution that Seamfix provides.

How Seamfix Can Help You Create A Seamless KYC Process

We are a leading provider of digital identity management solutions, trusted by over 1,000 businesses globally. Our solutions, including facial recognition and document verification, can help you:

- Onboard customers faster

- Combat fraud with biometric verification, such as mobile fingerprint capture and face match, with 99% accuracy.

- Stay ahead of compliance regulations with our comprehensive KYC solutions that cover 13,000+ documents globally.

Staying compliant doesn’t have to hinder your growth, we are the experts and we can help.

Contact us today for a free consultation and learn how we can transform your KYC process, so you can scale your business.