In 2019, a popular ride-hailing company lost its permission to work in London because many drivers faked who they were on the app. Imagine, over 14,000 trips were taken with drivers who weren’t really who they said they were. That’s a significant risk for every passenger.

Ride-hailing apps on phones make getting around cities so easy. It’s quick to create accounts and add payment info. But there’s a problem: when you sign up, they don’t always check who you are. Know Your Customer (KYC) is a crucial process for ride-hailing companies. It stops fraud by making sure drivers and riders are exactly who they say they are.

Drivers like working for companies that care about safety, where they’re less likely to have problems with passengers. Riders prefer services where they know drivers have passed proper checks, making them feel safer and more confident.

5 Most Common Fraudulent Activities in the Ride-hailing Industry

- Fake Accounts and Identity Theft: Fraudsters create fake accounts using stolen or fabricated identities to gain access to ride-hailing platforms. This allows them to pose as drivers or passengers, enabling them to engage in various fraudulent activities. Moreover, creating fake accounts adds complexity to the verification process, making it increasingly challenging for ride-hailing companies to distinguish between genuine and fraudulent users.

- Payment Fraud: Fraudsters use stolen credit cards or payment credentials to make fraudulent bookings or manipulate payment processes to divert funds. This can result in financial losses for both ride-hailing companies and their users.

- Incentive Abuse: Fraudsters exploit incentive programs and referral bonuses offered by ride-hailing companies to earn rewards illegitimately. They may create multiple fake accounts and use automation to generate fake rides and inflate their earnings artificially.

- GPS Manipulation: Fraudsters use GPS spoofing tools to manipulate their location data to simulate fake rides or to avoid paying surge pricing. This can distort ride data and deprive ride-hailing companies of legitimate revenue.

- Phishing and Account Takeovers: Fraudsters use phishing techniques, a prevalent social engineering attack, to target user data like login credentials and credit card numbers by tricking unsuspecting individuals into engaging with seemingly trusted email, instant message, or text message communications. Once they gain access to an account, they can manipulate it for fraud.

The Value Proposition of KYC For Riders, Drivers and Third Parties

Identity Verification for Riders (Self)

- Onboarding Verification: Seamfix Verify offers a suite of tools—biometric facial images, ID documents, and phone number verification—to confirm the identity of every new rider during sign-up. This establishes a solid foundation of trust and accountability right from the start.

Example: New users registering on the ride-hailing app undergo a seamless identity check, boosting security and confidence among riders. - Routine Verification: Our system ensures ongoing safety by perpetually verifying riders each time they use the service. Biometric verification maintains their identity validation, assuring the platform of a secure experience.

Example: Our system swiftly confirms the rider’s identity with each ride request, enhancing safety measures behind the scenes. - Existing Riders Verification: Existing riders can easily update their identity details through the app, allowing for continuous verification and profile integrity maintenance.

Example: If a rider changes their phone number or updates their ID, the app triggers a verification process, ensuring accuracy in records.

Third-Party Riders Verification

- Phone Number Verification: Seamfix Verify verifies third-party riders by cross-checking their provided images and information against their phone number, enhancing ride security.

Example: When booking for someone else, our system verifies the phone number and details, ensuring the legitimacy of the ride request.

Driver Verification

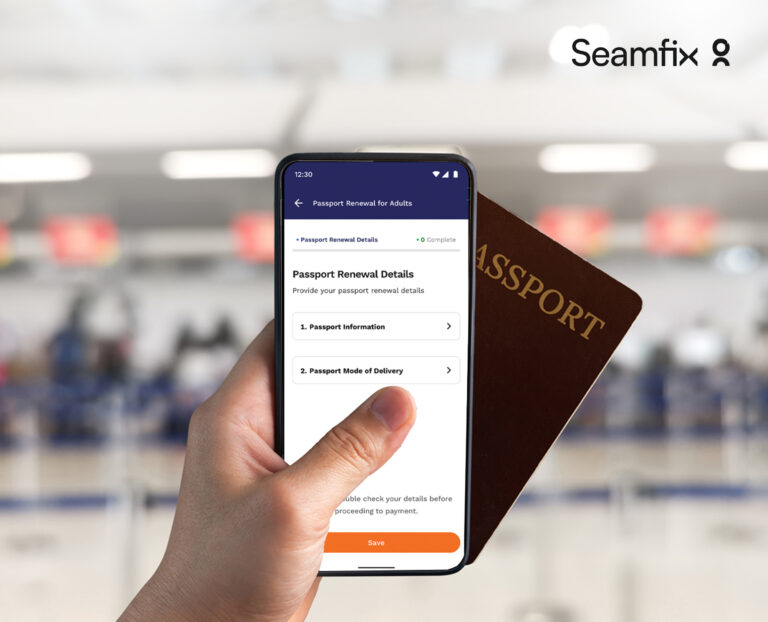

- ID and Background Check: Drivers undergo comprehensive document verification and background screening to ensure only trustworthy individuals join the ride-hailing platform.

Example: Potential drivers are rigorously checked for their ID credentials and criminal history, ensuring a secure and reliable pool of drivers. - Biometric Check: This method captures the driver’s facial features, mapping key points on the face to create a unique digital signature. When the driver logs in or initiates a verification process, the system compares their live facial image with the stored digital signature to confirm their identity.

Example: When a driver applies to join a ride-hailing platform, he provides his biometric data (facial images, fingerprints, etc.) during the onboarding or registration process, we compare it to the face on their government-approved document ID for a positive or negative match.

Our KYC services—biometric, ID, and phone number verification—aim to maintain safety for riders and drivers throughout their journey. From sign-up to travel, our goal is a secure and trustworthy environment for everyone involved in ride-hailing services. Create a free account, or contact our sales team for a personalized consultation.