In Nigeria, identity verification services have been useful in battling a lot of fraudulent activities and verification challenges today. Businesses, including the banking sector, are facing an increasing need to know if their customers are who they say they really are. They all need to be Know-Your-Customer (KYC) compliant. These processes are in line with regulations which helps to validate who customers claim to be.

The ability to verify an individual’s identity in real-time using a digital identity verification system is therefore very crucial. Thereby, this has tackled some key challenges here, in Nigeria;

The complex customer onboarding process

It is important that KYC and AML protocols are strictly followed. This is important during customer onboarding. Unfortunately, this slows down the onboarding process, and it also affects the user experience. We all want a customer-centric experience. Apparently, a great user experience strives to reduce any barriers that customers might have while simplifying processes

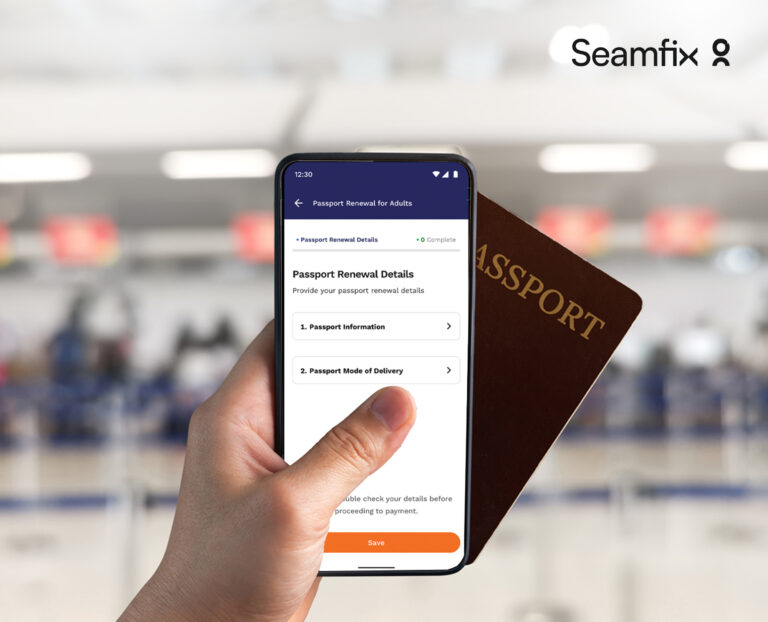

Due to this, lots of companies are turning to identity verification software to take care of the identity verification process. As a result, it speeds up the process as it keeps customer checks on file.

Distrust amongst businesses and customers

Trust is ideally important in any business. We all know customers actively seek out businesses they can rely on. In an era of endless privacy breaches, running identity verification checks builds trust. This is important in what’s becoming an unsafe online world today. Failure to identify this need for trust between customers and businesses can damage a business’s reputation, and also its source of revenue.

As online fraud rates increase, so are the digital needs of businesses. Nothing has been more important for businesses to be able to trust that their customers are who they claim to be. Again, this is where identity verification solutions in Nigeria come into play. Businesses do not just need to create a reliable process, but customers also expect a smooth, secure online experience as well.

Identity theft and fraud

An accusation of fraud can be the end of the road for a business, regardless of its size. As a result, organizations are increasingly leaning towards using models that embody identity verification. The models would have assessed suspicious users. Thus, this data can be used to create authentication levels. Furthermore, this is based on the risky possibilities of certain transactions.

Administrative burden

Having staff manually request and process ID documents can be a time-waster. This manual process can be completely avoided if a link is created directly from the user on your website to an online ID checking service. When done manually, there may be back-and-forth communication required over incorrectly formatted documents. But if the user is uploading it directly to the service, then validation is done instantly. This gives the user instant feedback if at all the format is incorrect, so they can retry.

Conclusion

As you know fraud rates are consistently growing yearly. We might likely continue to see this fraud rate increase as more businesses move online and go digital. As in this case may be, trust must be prioritized for businesses to succeed. This will not be possible without a secure and reliable Identity Verification Technology. Frauds and theft have scared businesses and customers. So it is important for businesses to implement a smooth identity verification process. A process that is customer-friendly and adheres to organizational guidelines. Bring into being, it could ease fears, avoid costly fines and fraudulent concerns.