When dealing with investors or customers, they must trust that the right services will be provided to the correct recipient at the right time. If your business can repeatedly scale this trust from one to millions of people, there’s unlimited room for growth.

Biometric Identity verification addresses this challenge by providing a fast, secure and reliable way to verify the identities of individuals, ensuring that only authorised individuals can access services and data.

Here’s a quick guide to using Face Match, a biometric tool for carrying out KYC (Know your customer) checks in seconds, anywhere and on any platform.

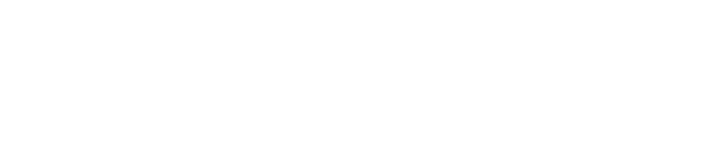

Understanding How Face Match Works for KYC

Face Match enables businesses to compare facial images from diverse sources, such as ID documents, live camera pictures, government facial databases, or proprietary databases. Advanced facial biometrics algorithms then determine the authenticity of the user, providing a robust means of identity confirmation.

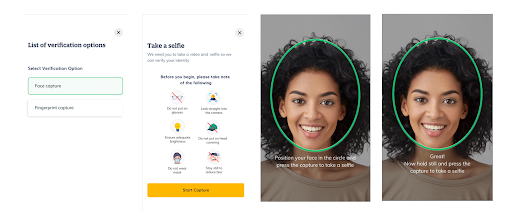

Here’s how it works in 3 easy steps

Step 1: Snap a Selfie: Users can effortlessly capture a selfie using their mobile device or webcam.

Step 2: Cross-Verify with ID: Retrieve their image from a government database or ID document for enhanced security.

Step 3: Compare facial images: Our advanced Face Match Algorithm gets to work, comparing the captured image (Source) with the official ID image (Target), after which you receive a real-time matching score, instantly establishing the customer’s identity.

Key Features:

Source Flexibility: Choose from two photo sources for a Face Match.

User Control: Set the matching threshold according to your preferences, allowing you to approve or reject users with precision. This feature adds a layer of customisation, ensuring that the tool aligns perfectly with your business requirements.

Widespread availability: Conduct biometric checks globally or screen ID documents from governmental databases in 226 countries worldwide.

Seamless Accessibility: Facematch is designed to fit seamlessly into your workflow with or without coding and technical support. Generate a custom link in seconds and share it with your customers, verify directly from the web or integrate into your mobile application via API and SDKs

How to Unlock Growth with Face Match

Identify Your Use Case:

- Financial Services: Combat online fraud, accelerate user onboarding, and ensure robust identity verification.

- Telecommunication: Register customers faster, prevent sim swap fraud, and streamline agent onboarding.

- Hospitality Sector: Speed up guest check-ins, verify identities, and eliminate the risk of fraudulent bookings.

- Airport Security: Automate immigration checks, enhance security, and expedite boarding.

- Human Resources: Add transparency to hiring processes, validate applicant and employee identities, and prevent false claims.

Choose the Right Integration:

- APIs and SDKs: For developers seeking a customised integration into existing systems.

- No-Code Solution: Ideal for quick implementation without extensive coding requirements.

- Web/Mobile SDKs: Easy accessibility through web or mobile applications.

Test and Iterate:

- Pilot Testing: Implement Face Match on a smaller scale to identify initial challenges and gather user feedback.

- Feedback Analysis: Analyze user feedback and performance metrics to identify areas for improvement.

- Iterative Refinement: Make necessary adjustments based on feedback, ensuring continuous improvement.

Since its implementation, Seamfix Verify’s customers have onboarded over 3 million customers within a mere 40 days. Our Face match solution reduced fraudulent cases by over 90% in SIM swaps for a telecom giant, protecting customer accounts and preventing unauthorised access.

Face match complies with industry regulations easily by enabling biometric identification 100% faster than before and matching faces with up to 90% accuracy.

Boost your onboarding workflow with the Face Capture widget. Speak to our sales team for a one-on-one consultation.