Since 2019, there has been a 17% surge in biometric and document fraud across Africa. This isn’t just a faceless statistic; it’s about Stephanie, the Congolese student who was denied her voice in the democratic process due to a faulty ID card, or Kweku, the Ghanaian entrepreneur whose details were used to open a bank account to receive fraudulent inflows.

Navigating weak data infrastructure

Fraudsters exploit vulnerabilities to steal information, create fake identities and use them for malicious purposes. Seeing as data is the new currency, the question is, “Who are you trusting with sensitive data’’?

In South Africa, a finance staff member at a multinational company was tricked into paying over $25 million (approx. R450 million) to fraudsters due to a realistic fake video of the CFO. While in Kenya, a backlog of identity card applications reaching 600,000 highlights the strain on existing verification systems.

The good news? We’re not powerless. The Ugandan central bank’s recent directive requiring ID verification for high-value digital transactions is a step towards securing financial services. In Nigeria, the central bank has also mandated that all bank accounts be verified with National Identity Numbers.

But governments can’t do it alone. You too as a business owner can be a part of the solution by protecting sensitive customer information.

Here’s how:

- Security starts with choosing the right verification partner. Conduct thorough research on their security practices, data storage protocols, and regulatory compliance. Look out for certifications and industry best practices.

- Only collect the information absolutely necessary for verification purposes. The less data you store, the less vulnerable you are to breaches.

- Invest in robust encryption and access controls to safeguard sensitive customer data.

- Be transparent and communicate with your customers about how their data is collected, used, and protected.

- Prepare a data breach response plan to notify customers promptly and minimize damage in case of an incident.

- Follow your industry’s best practices and regulatory requirements to the letter. They help protect you from fraud and hefty fines.

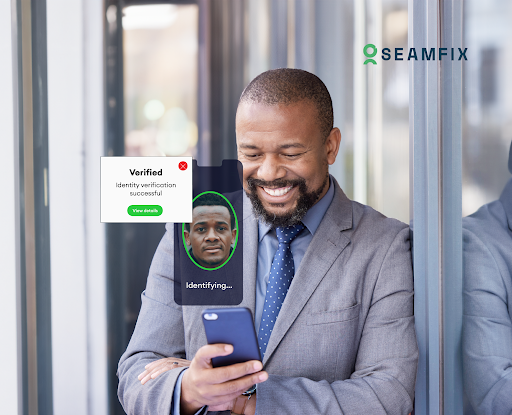

Looking for The Best Identity Management Provider?

You’re in the right place. Here’s why over 1,000 businesses trust Seamfix.

- We have partnerships with critical stakeholders like the Nigerian National Identity Management Commission (NIMC).

- We’ve helped multinationals,financial services providers and telcos across Africa meet stringent regulatory compliance requirements.

- Our solutions have enabled biometric registration for over 100 million SIM subscribers and over 80 million National identity numbers.

Business success starts with robust identity management. Contact Seamfix today for a FREE consultation. We’ll help you learn how to protect your customer’s data while meeting regulatory requirements.