Guarantor verification is the process of verifying the identity and suitability of a guarantor for an individual or a business. A guarantor is a person who takes responsibility for paying a debt or fulfilling an obligation on behalf of another person.

Verifying a guarantor’s details helps reduce the risk of fraud, defaulting, and other forms of financial loss, making it an essential component of background checks. Seamfix Verify, a leading background check and identity verification service provider, offers four types of background check services. They are:

- Academic Record

- Criminal Record

- Identity Verification

- Guarantor Verification

- Address Verification

By adding the Guarantor Verification service to our portfolio, we continue to provide reliable, fast, and accurate background check services worldwide.

How Guarantor Verification Works

Suppose you want to hire an applicant (John), and John provides one or more guarantors as specified by you, his employer.

Follow these simple steps below to use Verified.africa’s guarantor verification service:

- Log into the Seamfix Verify Portal with your username and password

- Select the country of your choice (e.g. Nigeria) on the left side of your dashboard

- Select “Background Check Services” and click on “Guarantor Verification”

- Click on “new request”, which will display the options of “single” or “bulk” request

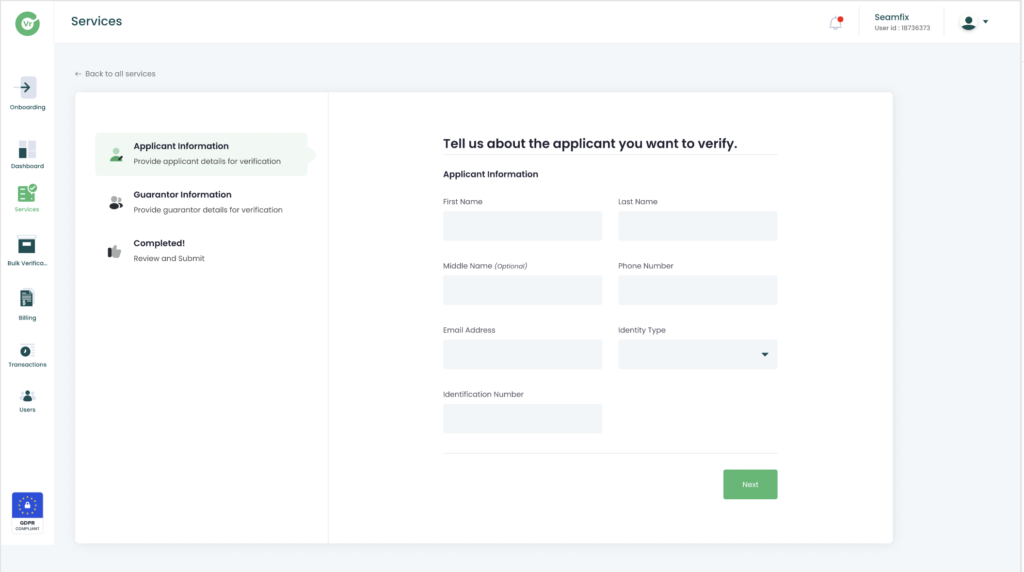

- Input the applicant’s KYC details, and then input the details of their guarantor

The applicant only needs their full name, email address, phone number, identity type (e.g. BVN, Drivers Licence, International Passport, Voters Card) and the Identity Number of the chosen identity type.

Each of these details is required for a successful verification to be done as the first step.

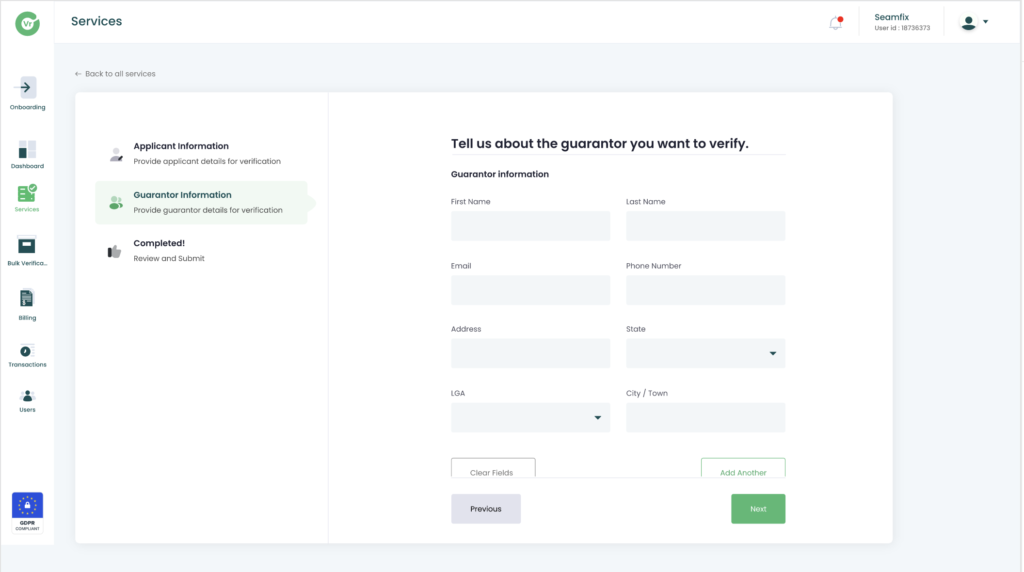

On the other hand, the guarantor’s information is slightly different from that of the applicant. To begin this process, the guarantor’s full name, email address, phone number, residential address, state of residence, local government, city, and town are required and will be included in the request.

Be sure to review the provided information before you click “submit”. All these details must be obtained from the applicant before the process commences.

The Guarantor’s Verification

After successfully inputting these details in the guarantor verification section, click submit and wait for the results to return to you.

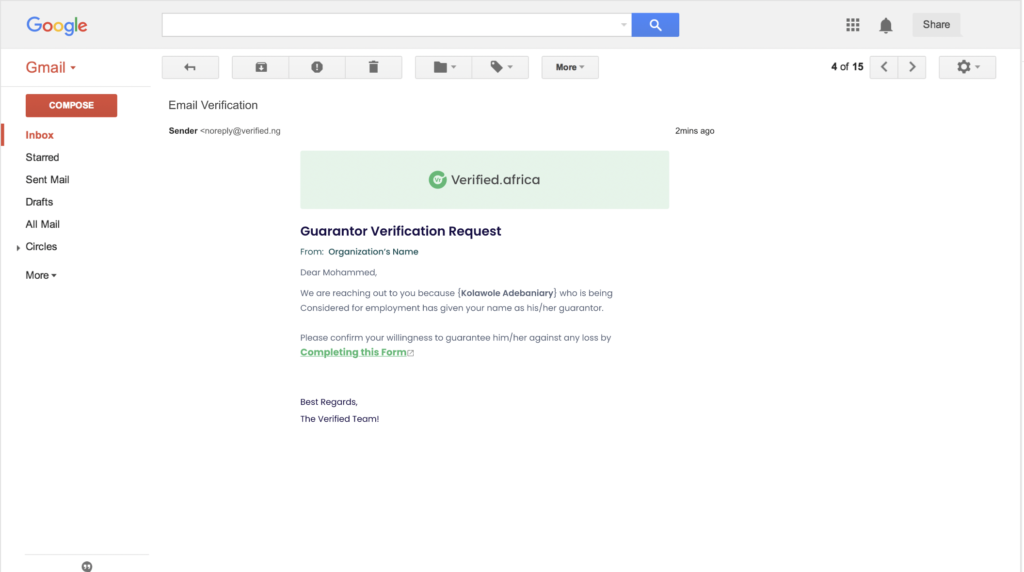

An applicant’s ID checks are done immediately, and the report can be viewed once you have submitted the request. The applicant’s guarantor, on the other hand, receives an email similar to this:

“Dear (guarantor name),

We are reaching out to you because (applicant name – John), who is being considered for employment, has listed you as their guarantor. Please confirm your willingness to guarantee him/her against any loss by completing this form (link to form).

Best regards,

The Verified Team”

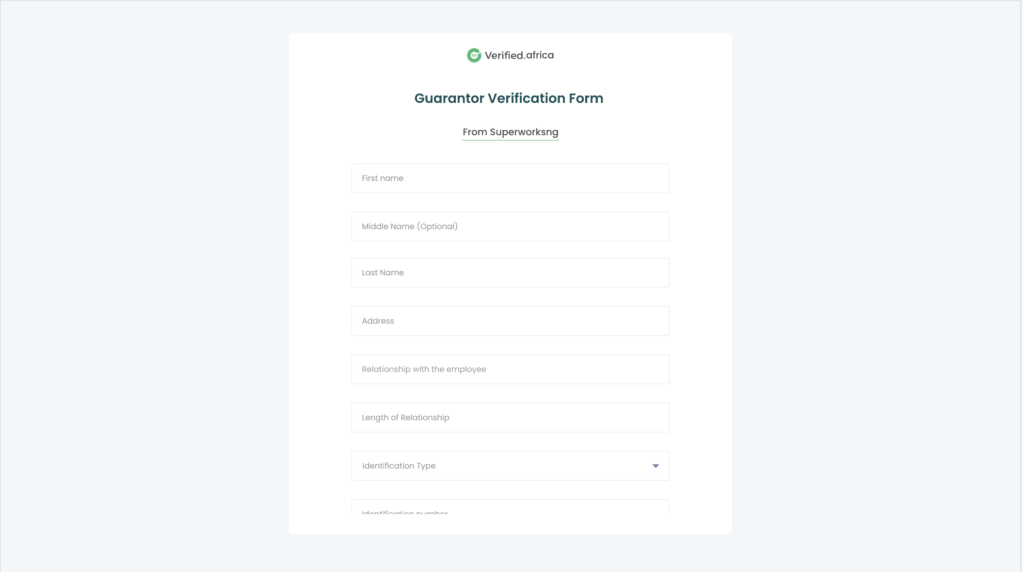

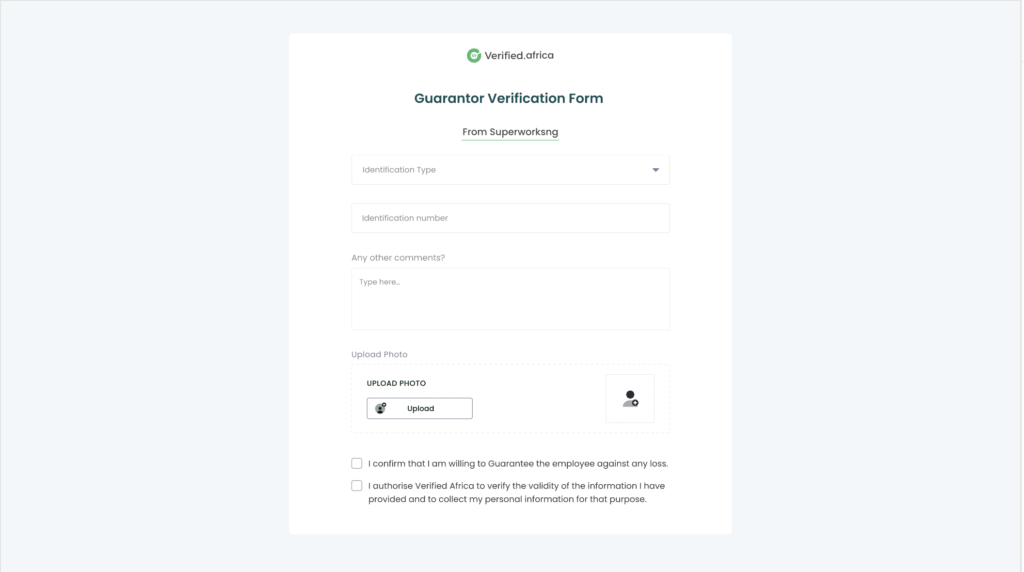

The applicant’s guarantor receives an email notification/consent form when they click on the link above. The form displays the following, which will be filled with the correct information:

- Full name of the applicant/guarantor

- Guarantor’s address

- Relationship with applicant

- Length of relationship

- Identification type and identification number

- Additional comments

- Photo upload

- Agreement to the terms of service listed in the checkboxes

The request is processed within 5-7 business days. You will be notified via the portal and email when this process is completed. The message will read something like this:

“Congratulations, the Guarantor request is now completed successfully. You can view the complete report, including the identity provided for the customer and the identity verification for the guarantor.”

The Importance of the Guarantor Verification Service

Guarantor Verification offers several benefits, some of which are but are not limited to:

- Ensuring Credibility: By verifying the identity and credibility of guarantors, individuals and organisations can make informed decisions and mitigate risks.

- Fast and Reliable Service: Our guarantor verification request is processed within 5-7 business days, providing fast and reliable service to your business and stakeholders.

- Compliance: Guarantor verification enables organisations to comply with regulatory requirements, such as Know Your Customer (KYC) and Anti-Money Laundering (AML) policies.

- Assurance Amidst Uncertainty: Guarantor Verification provides security and confidence to individuals and organisations, knowing that the guarantors are trustworthy and credible.

At Verified.africa, we take pride in providing reliable, fast, and accurate background check services throughout Africa.

So why wait? Try our Guarantor Verification service today and experience the peace of mind that comes with a trustworthy background check.