Remember the Star Wars movie? Artificial Intelligence (AI) is not limited to science fiction alone; it’s a technological powerhouse transforming industries across the globe. Its ability to process vast amounts of data at lightning speed and make sense of complex patterns makes it a game-changer in various fields, and KYC is no exception.

Documents that took days to review and verify are now processed in seconds. AI-powered systems analyse customer documentation, cross-referencing with governmental databases to spot matches, anomalies, and potential risks.

This blog details AI and biometrics in KYC, exploring how your business can leverage them efficiently to drive revenue and customer trust.

Biometrics in Identity Verification

At its core, Biometric KYC uses distinct physical or behavioural traits to verify an individual’s identity. It’s like a digital storehouse that’s virtually impossible to replicate. Across industries, such as finance, healthcare, and online services, Biometric KYC is the cornerstone for building trust, preventing fraudulent activities, complying with regulatory standards and protecting sensitive information.

Why should you adopt biometrics for ID verification? For starters, it’s a security castle that’s nearly impenetrable. Unlike passwords or PINs, which can be lost, forgotten, or stolen, your biometric traits are inherently yours, simplifying the user experience.

Whether it’s guest check-in at a hotel or accessing your online banking, biometrics is creating a seamless bridge between your business and millions of online customers.

As the global biometric market’s revenue surged to $43 billion in 2022 and may reach $83 billion by 2027, the convergence of AI and biometrics is shaping a new method of customer onboarding—one where security and convenience walk hand in hand.

AI-Powered Face Match and Liveness Detection

Face match technology involves using algorithms to compare live images of an individual with reference images, typically taken from official documents like passports or driver’s licenses. The process determines whether the person in the live image is the same as the person in the reference image, thereby verifying their identity.

How Face Match Works:

Face Match employs advanced machine learning algorithms to analyse facial features and patterns. When a user submits a live image (selfie) and a reference image (e.g., passport photo), the system extracts key facial landmarks, such as the distance between the eyes, the nose shape, and the jawline’s contours.

These features are converted into numerical data and compared between the live and reference images. The system calculates a similarity score that indicates how closely the two images match – all done in seconds!

Introducing Liveness Detection:

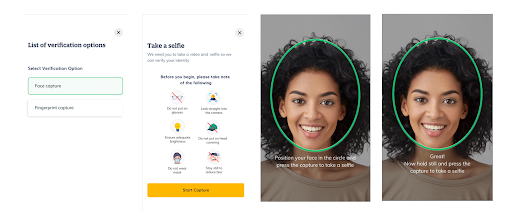

Liveness detection, on the other hand, is a crucial component of biometric authentication systems that prevents spoofing attempts. Spoofing involves using static images, videos, or masks to impersonate a live person.

Liveness detection adds an extra layer of security by ensuring the authenticated individual is physically present, not just a digital representation.

How Liveness Detection works:

There are two significant types of liveness tests:

- Passive Liveness Detection: Distinguish between a live face and a static image or video. For instance, if someone tries to gain access to your bank account using a photo from your social media, our AI is trained to detect the lack of vitality in the image, promptly denying access and raising the alarm for potential fraud.

- Active Liveness Detection: Analyze the subject’s behaviour patterns, requiring them to perform specific actions to prove their presence. Afterwards, our face match feature corroborates the live image with a target image, such as their national ID card, for a more comprehensive identity verification process.

As you validate that your customers are genuine and physically present through their biometrics, your business can confidently onboard customers and provide swift access to your services. Something we all want

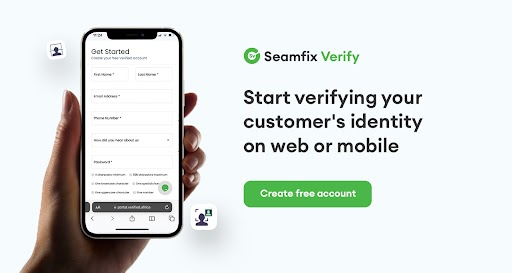

Seamfix Verify, a platform using AI-powered face match and liveness detection, offers various verification workflows:

- Face Capture Only: Capture customer images alone for seamless verification.

- Face Capture Plus Face Match: Add an extra layer of security by comparing a live image with a reference image.

- Face Capture Plus ID Match: Verify facial details and identification documents side by side for an accurate onboarding experience.

We’ve implemented these workflows in various industries, including:

- Telecommunications: Preventing sim swap fraud by verifying images.

- Fintech: Simplifying sign-up and sign-in with real-time authenticity checks.

- Banking: Matching live images with stored images for secure transactions.

- Ride-Hailing: Validating driver and passenger identities for platform security.

- Hospitality: Streamlining guest check-ins with real-time AI checks.

With our services, businesses can enhance security, comply with regulations, reduce fraud, and provide a seamless user experience.

Here’s how we’ve done so for some of the world’s most trustworthy brands.

Case Study: Verified.africa’s Advanced Solutions:

MTN’s Enhanced Verification Process:

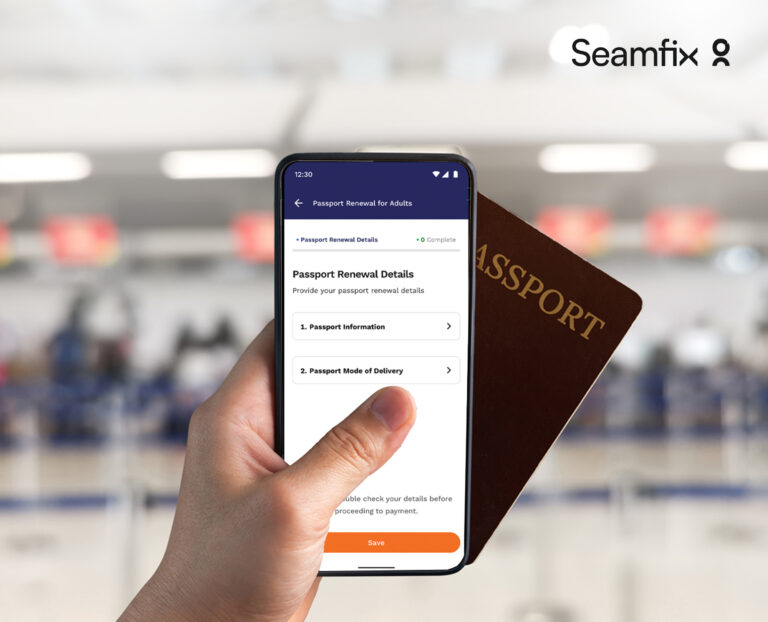

MTN, Africa’s most extensive network operator, recognised the critical need for a secure verification process for customers registering for SIM cards or requesting SIM swaps. To achieve this, MTN integrated Seamfix Verify’s AI technology, incorporating background cleanup, face matching engine, and passive liveness detection checks.

This integration significantly elevated the accuracy of image matching. By leveraging our advanced solutions, MTN successfully enhanced customer verification, slashing digital fraud by up to 90% and accelerating customer onboarding by 100%.

Union Bank’s BVN Facial Matching:

Union Bank, a pioneering commercial bank, aimed to precisely match customer-provided pictures with images stored in the NIBSS database while opening digital bank accounts.

Through API integration with Verified.africa, Union Bank performed BVN facial matching with precision, enhancing the accuracy and security of their identity verification process, leading to the swift onboarding of thousands of customers.

Invest Bamboo: Tackling Dual Identities with Real-Time Verification

Invest Bamboo, a brokerage firm, encountered identity fraud threats like dual identities during customer onboarding. To overcome this hurdle, they seamlessly integrated our real-time verification API into their mobile app, enabling authentication of National Identification Numbers (NIN) and Bank Verification Numbers (BVN), effectively preventing instances of dual identities.

The outcome? A streamlined process that bolstered user trust and eradicated fraudulent activities, allowing Invest Bamboo to process over 5,000 sign-ups monthly successfully.

These case studies exemplify Seamfix Verify’s dedication to delivering AI-powered solutions that improve security for businesses and their customers.

Getting Started with Biometric KYC:

Seamfix Verify offers a comprehensive suite of AI-powered KYC solutions that seamlessly facilitate secure and efficient onboarding.

To learn more, schedule a free demo session with our product experts. During this session, you can discuss your unique requirements and explore the tailored solutions best suited for your business. Our dedicated team will collaborate closely with you to design a customised integration process, leveraging SDKs and APIs to seamlessly implement the face match and liveness detection services directly into your workflow.

Whether you’re a startup or an established enterprise, we are committed to aiding you in meeting your KYC requirements and delivering extraordinary customer experiences. First, sign up for free or book a demo today, and start enjoying our AI-powered solutions.