How much time do you spend confirming transactions for your top customers? Five minutes? An hour? Two hours? Ever skipped important tasks because you were scheduling multiple virtual calls just to authenticate a transaction for a customer? We get it.

In the European Economic Area (EEA), payment fraud reached €4.3 billion in 2022, with another €2.0 billion lost in just the first half of 2023—mostly through credit transfers and card payments, all of which were not initiated by the customer. And it’s not just Europe. In 2023, 80% of organizations globally faced payment fraud attempts, but only 30% managed to recover all lost funds.

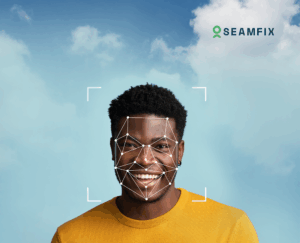

This highlights the need for stronger, faster transaction authentication. That’s why we’re introducing BiometricConsent®—an AI-powered self-service that offers secure transaction authentication anytime, anywhere. No delays, no hassle. Just instant, efficient approvals when your customers need them most.

Why Current Authentication Methods Are No Longer Sufficient

Financial institutions are constantly under pressure to monitor transactions over certain thresholds, as the threat of fraud and regulatory sanctions persist. Recent fines, like the €1.5 million slapped on Crédit Agricole and €2 million for Robeco, highlight the severe financial cost of failing to comply with AML regulations.

With nearly 90% of bankers concerned about cybersecurity compliance, security measures have never been more critical. In response, many banks have turned to scheduled video calls for transaction authentication—but this method has its flaws; customers often face long waits for available agents, leading to frustration, transaction abandonment, and lost business.

Technical issues like poor video quality and connection glitches only add to the hassle. As transaction volumes grow, relying on scheduled calls becomes unsustainable, especially for urgent approvals outside regular hours.

Then, there’s the growing threat of synthetic identities. Fraudsters are getting more sophisticated, using techniques like deepfakes to spoof identities during video calls. Synthetic identity fraud could cost the industry US$23 billion by 2030, and an alarming 95% of these fake identities slip through during onboarding.

When fraudsters break through, they can open accounts, secure loans, and apply for credit cards—all under fake identities. The real challenge for banks is stopping these fraudulent activities while keeping the process smooth and convenient for legitimate customers. It’s a delicate balancing act that calls for smarter, more reliable solutions.

Introducing Biometric Consent, Your Seamless Solution for Secure Transactions

Biometric Consent lets your customers authenticate transactions securely online via your mobile or web app—no need for meetings or branch visits. Our self-service offering ensures that transactions over a certain threshold are authenticated instantly, day or night, giving your customers the speed and convenience they expect.

Powered by advanced AI, our solution uses active liveness detection and face match, adding an extra layer of biometric security to transactions.

For account managers, the system offers real-time control and visibility. You’ll know the status of every authentication request instantly—whether it’s pending or completed. Our platform follows all relevant banking regulations and security standards, so you can be sure your clients’ transactions are protected from start to finish. The intuitive design also makes it easy to use, requiring minimal training.

What about compliance? We’ve got it covered. Every authentication is automatically logged and accessible to you, making regulatory requirements easier to meet. Our BiometricConsent® Engine reduces the risk of fraud and ensures non-repudiation, all within a framework built to keep your operations secure and compliant.

Setup Biometric Consent in Minutes

The future of transaction authentication is here—simpler, faster, and more secure than ever. With BiometricConsent®, you can say goodbye to the hassle of virtual meetings and manual transaction authentication.

Integration is also a breeze—no disruptions, no downtime. Our system fits seamlessly into your existing workflows and scales effortlessly as your bank grows.

Interested in learning more? Schedule a quick call with us today to see how you can save time, cut costs, and satisfy your customers. Your top clients are ready for a faster, more secure experience—let’s give it to them.