Customers check their mobile banking app between 50 and 80 times for every visit to a physical bank branch. This data emphasises the importance of mobile apps, and getting your customers to use them smoothly and hassle-free is a big deal.

But there’s a problem: making sure new customers are who they say they are can be tricky; a challenge called KYC (Know Your Customer) is the initial step in the user’s journey. You know, like getting your ticket before watching a blockbuster movie. Unfortunately, this necessary step can be confusing and frustrating for many users.

This guide will summarise everything on KYC and mobile app customer onboarding. And give you the knowledge necessary to make your mobile apps the preferred choice for your customers.

The Mobile App Onboarding Landscape

Think about this: every tap on a mobile app is an opportunity to make a lasting impression. The smoother the initial experience, the higher the likelihood of retaining users. An easy onboarding process leads to positive reviews, more downloads, and better engagement.

In Africa, over 270 million users spend a third of their time on mobile apps. Notably, the fintech sector has grown substantially, with startups raising billions and mobile app marketing taking centre stage.

Yet, app retention rates are low: A mere fraction, less than 10%, of users continue engaging with an app beyond two weeks, while a staggering 71% churn within the first 90 days. Effective onboarding is the antidote.

Industry expert Ankit Jain highlights the importance of these initial days of user interaction:

“Users try out a lot of apps but decide which ones they want to stop using within the first three to seven days. The likelihood of prolonged engagement increases significantly for apps that retain users for a week. So the key to success is to captivate users during the critical initial period.”

So, what exactly is onboarding? It’s the virtual red carpet for users as they enter the app – aimed at enabling them to derive value promptly.

Onboarding has three main objectives:

- Education: Help users understand your app. Without this, they might leave.

- Setting Up: Onboarding facilitates account creation for apps requiring user accounts.

- Personalization: Onboarding is the perfect time to ask for permissions or info. For example, Quora asks for user interests, while fintech apps like Cowrywise mandate a Bank Verification Number (BVN).

User onboarding bridges the gap between app downloads and sustained engagement. Nailing this process is pivotal to app success and user satisfaction.

Understanding KYC: A Fundamental Overview

KYC, or Know Your Customer, is the foundation of secure business-customer relationships. It entails verifying customers’ identities, and it’s far from a one-time event; instead, it’s a continuous process that initiates during onboarding and persists throughout the customer journey. The ultimate objective is to mitigate risks associated with customer interactions.

KYC serves a vital purpose: to prevent financial crimes like money laundering, corruption, and terrorism financing by exposing false identities used for illegal activities.

Here’s how KYC works:

- Document Verification: Customers provide valid identity proof.

- Verification Methods: Identity documents undergo verification to ensure authenticity.

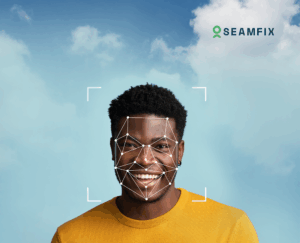

- Security Checks: Biometrics and other security measures confirm identity.

- Transaction Authorization: Once their identity is verified, customers can initiate transactions.

Traditionally, KYC mandates the collection of user data and official documents, a process that often leads to user drop-offs and revenue loss. However, innovative alternatives, such as AI and machine learning-powered solutions, swiftly validate identities by cross-referencing them with government databases in real-time.

For product teams, streamlined KYC processes are paramount for compliance and fraud prevention, enabling them to enhance the user experience, boost revenue, and protect their platform’s integrity.

KYC Integration in Mobile App Onboarding: Benefits and Challenges

In a competitive market, digital companies aim for smooth sign-ups while meeting KYC demands to deter fraudsters.

Consider Nigeria, the largest customer market in Africa. While the country boasts tech unicorns and substantial fintech investments, it also grapples with prevalent fraud and tax evasion issues. Therefore, addressing these challenges while onboarding Nigerian users is essential.

Let’s explore the benefits and tackle the key challenges businesses face in optimising their Know Your Customer performance.

Advantages:

- Enhanced Customer Experience: Streamlined onboarding improves security and reduces friction, creating a hassle-free sign-up experience.

- Increased Customer Acquisition: A smoother onboarding process leads to fewer drop-offs, boosting customer conversion rates.

- Improved KYC and AML Compliance: Real-time processing and near-instant access to data facilitate compliance without hindering growth.

- Cost Reduction: Automation minimises manual intervention, curbing support costs and compliance risks.

Challenges:

- User Experience: A seamless onboarding experience hinges on minimal information input, intelligent recognition algorithms, transparent guidance, robust security measures and the ability to access the process across various channels.

- Technological Robustness: The technology deployed must offer reliability, ensuring that inaccuracies and repeated processes don’t frustrate users.

- Quality of Data: Poor data quality disrupts smooth onboarding processes. Siloed data complicates processing and sorting, ultimately hindering a positive customer experience.

- Ever-changing regulations: Integrating compliance practices can be complex and time-consuming, as businesses must find ways to balance the practices with security and user experience.

Best Practices for KYC-Enabled Mobile App Onboarding

The following practices ensure a user-centric and efficient KYC onboarding experience:

- Collaboration: Foster cross-functional cooperation between product, design, compliance, and development teams to ensure a harmonised onboarding process. Strategically integrate KYC checks within the customer journey to minimise friction and follow mobile app best practices by requesting KYC-related information only when it’s most relevant, reducing drop-off rates.

- User Education: Educate users about the significance and advantages of KYC, building trust and transparency from the start. You can identify critical milestones in the verification process and build targeted campaigns around them. For instance, if linking a bank account is pivotal, create messaging that guides users through the process or use game-like tactics, such as collecting points or unlocking levels to engage users.

- Automation: Embrace automation to streamline verification procedures, minimise manual efforts, and accelerate user onboarding. Leveraging biometric solutions like face capture and video consent provides rapid and accurate ID validation, preventing identity theft and offering enhanced convenience on mobile devices.

- Scalability: Design onboarding processes to handle increased user volumes while upholding quality standards. You can start by collecting essential customer contact information and adopting a tiered KYC approach, offering escalating functionalities when customers meet higher KYC requirements.

- Iteration: Gather user data and analyse onboarding outcomes to refine the process. Metrics like daily, monthly, and weekly active users, conversion rates, and retention tables provide insights for continuous improvement. Then, tailor personalised messages based on drop-offs and critical events to address specific issues and enhance user engagement.

By applying these practices, businesses can create an optimal KYC-enabled mobile app onboarding experience that meets regulatory compliance, cultivates user satisfaction and long-term loyalty.

Case Studies: Successful KYC Onboarding in Mobile Apps

Below are some concrete case studies highlighting successful KYC integration. These examples showcase how African businesses effectively tackled KYC challenges and significantly improved customer onboarding:

- Invest Bamboo: Tackling Dual Identities with Real-Time Verification

Invest Bamboo, a brokerage firm faced difficulties with dual identities and identity fraud during customer onboarding.

To address this issue, they seamlessly integrated Seamfix Verify’s real-time verification API into their mobile app, allowing them to authenticate National Identification Numbers (NIN) and Bank Verification Numbers (BVN), effectively preventing instances of dual identities.

The result? A streamlined process that bolstered user trust and eradicated fraudulent activities, enabling Invest Bamboo to process over 5,000 sign-ups monthly successfully.

- First Bank of Nigeria: Simplifying Field Account Opening

First Bank of Nigeria sought to expand their customer acquisition efforts through an innovative Agency Banking Platform, enabling account opening outside traditional bank branches.

By leveraging Seamfix Verify’s document verification services, First Bank’s agents gained the ability to verify customers’ identities instantly and create accounts directly through a mobile app. This transformative change reduced the previously lengthy verification process from 24 hours to seconds, eliminating the need for cumbersome paperwork.

- Fincra: Enhancing Address Verification for Secure Transactions

Fincra, a payments company, grappled with the challenge of inaccurate addresses, which resulted in transaction delays and increased fraud risks.

Fincra implemented Seamfix Verify’s address verification API to overcome this obstacle. This strategic solution significantly expedited disbursing loans to genuine customers, thereby reducing the risk of fraud. Additionally, the implementation led to tangible improvements in cost savings for the company.

- Cowrywise: Balancing Security and User Experience

Cowrywise, a prominent savings and investment platform, prioritised the delicate balance between security and user experience as they expanded their services.

They took a measured approach to integrating features like KYC and BVN verification by progressively introducing new features to their existing services and supplementing them with educational content. This approach enhanced security measures and ensured compliance with industry regulations.

- MTN Nigeria Onboards 3 million Customers in 40 days

In a remarkable feat, Seamfix Verify’s Face Capture widget facilitated the onboarding of three million customers for a prominent African telecom giant within 40 days. The integration of this solution led to a remarkable reduction of fraudulent cases by over 90% during SIM swaps.

Through this advanced AI solution, MTN Nigeria achieved swift regulatory compliance, boasting biometric identification that was a hundred times faster than before, with a facial recognition accuracy of up to 90%.

These case studies exemplify the importance of tailored solutions that balance regulatory compliance and user experience to drive growth and success.y

Partner with Seamfix Verify for Seamless Onboarding

Whether you’re a startup or an established enterprise, Seamfix Verify can assist you in meeting your KYC onboarding needs.

Start your journey today by signing up for free on our user-friendly portal. Or schedule a 15 minute demo with our sales experts. With Seamfix Verify, you can build a seamless onboarding experience for your customers, fostering trust, security and positive user engagement.