You may have an outstanding product and a solid understanding of KYC (Know Your Customer). However, these ID verification errors can negatively affect customer retention and drain resources. What if I told you the solution might be simpler than you think?

If you’re having trouble with your current verification process or looking to avoid potential risk in the future, this guide is perfect for you.

Here are five identity verification errors to avoid for a Seamless KYC Process.

Lack of Clear Goals

Ever heard of “Mogbo Moya“? In Nigerian slang, it refers to people who attend parties without an invitation. They’re there for the free food, captivated by aesthetics, or simply following the crowd.

Being a “Mogbo Moya” in your industry means integrating KYC services without precisely understanding your needs. This can lead to substantial drawbacks—choosing the wrong provider, falling short of compliance regulations, or alienating your customer base.

Set concrete goals and establish well-defined business requirements. For instance, a plan like “Register our customers seamlessly on our mobile app” demands a swift onboarding process with document verification.

Seamfix Verify offers the clarity needed to align your goals with actionable strategies. Our product experts act like a compliance team, ensuring efficiency and airtight security. Schedule a call to explore tailored solutions.

Choosing the Wrong KYC Solution

Once you’ve precisely outlined your KYC goals and business requirements, find a provider that aligns seamlessly with your needs. Consider factors like verification speed, scalability, prices, and coverage.

- Verification Speed: Choose a solution that ensures swift and seamless verification without compromising accuracy.

- Scalability: As your business expands, so should your KYC solution. Opt for a provider that can scale alongside your growth, effortlessly accommodating an increasing volume of verifications.

- Prices: While cost is a factor, weigh it against the value provided to balance affordability and available services.

- Coverage: Consider the geographical reach of the KYC solution. If your operations span multiple countries, a provider with an extensive range ensures consistency and compliance.

For more details, we’ve prepared a comprehensive guide to choosing the right KYC provider. If you’re looking for an all-encompassing solution, Verified.africa is the premier identity verification provider.

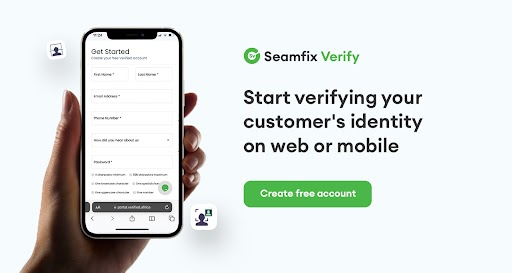

With coverage across multiple countries, competitive pricing, and diverse services, we offer an integrated experience for web and mobile applications. Take the first step by signing up for free on our portal.

Ignoring Modern Technology and Data Measures

Every year, fraudsters refine their methods. If you snooze, you lose. Traditional verification methods are no longer sufficient, making it imperative to integrate cutting-edge technology like biometric authentication and artificial intelligence (AI) into your KYC processes.

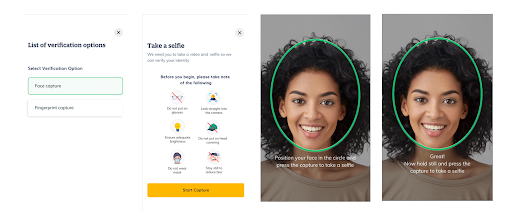

Seamfix Verify boasts innovative services such as Face Match, Liveness Detection, and Background Cleanup to provide a robust solution to security threats. See how our AI services can work for your business by booking a demo [here]

Your responsibility doesn’t end with customer authentication; where do you store your customer’s data? What do you do with it? Many companies overlook the post-authentication phase, unwittingly exposing sensitive information to potential breaches. To improve your defences:

- Robust Encryption: Prioritize advanced encryption protocols to shield customer data from unauthorised access.

- Secure Storage Practices: Implement safe data storage practices to ensure the integrity and confidentiality of customer information.

- Strict Access Controls: Limit access to sensitive data with stringent access controls, minimising the risk of internal threats.

Staying ahead of your competition demands innovation in customer verification and a commitment to securing the data generated. This twofold approach is your strategic advantage in the ever-evolving landscape of cybersecurity.

Lack of Customer Education

Your customers may not share your familiarity with identity verification. When they encounter requests for documents like their national ID, do they understand why?

Educate your users about the significance and advantages of KYC. Consider the verification process as a journey where each step is a milestone, and you strategically educate users at each checkpoint. For example, Cowrywise, a financial savings app, integrated KYC and BVN verification progressively, supplementing the process with educational in-app videos.

By making the educational component engaging and relevant, you turn a compliance step into an enjoyable and user-friendly experience.

Complicated User Experience

In consumers’ minds, if it’s not easy to use, it’s as good as ineffective. An easy onboarding process leads to positive reviews, more downloads, and better engagement.

Striking the right balance between robust security measures and user-friendly processes is crucial. Simplify where possible, deploy clear instructions, and minimize steps. Consider the user’s time and attention span as precious resources.

Your KYC provider is essential here. If integrating their services into your apps feels like navigating a complex puzzle, it not only puts a strain on your development team but also trickles down to impact your customers.

Make the right choice for your users. Opt for a KYC provider that prioritizes security and champions a user-friendly experience. The two are not mutually exclusive; they are, in fact, interdependent.

Build a Robust Identity Verification Framework

Avoiding these common identity verification errors isn’t just about compliance; it’s about building a foundation of trust and security. A KYC provider like Seamfix Verify understands the delicate balance required. We designed our solutions with safety in mind and a keen awareness of the end-user experience.

Your customers deserve a process that feels like a breeze, and we ensure that from start to finish, the verification journey is as seamless as possible.

Contact us for personalized insights and explore how Seamfix Verify can assist in compliance and establish a secure and swift KYC process for your customers. We don’t just offer solutions; we’re here for ongoing support and collaboration.