In 2023, the banking industry faced a whooping $6.6bn in compliance fines due to AML (Anti-money laundering) and KYC (Know your customer) requirements, a significant increase from $4.2bn in 2022.

It’s obvious, isn’t it? Meeting compliance is a big need, and now more than ever, regulatory bodies like the CBN (Central Bank of Nigeria) are pressing hard on banks to tighten up loose ends and eliminate all loopholes for fraud.

One of these loose ends is the NIN (National identity number) and the BVN (Bank verification number). For many banks, it might feel like just another compliance hurdle to jump over. But what if we told you it could be an opportunity for a strategic advantage?

What is the CBN’s Mandatory NIN/BVN Policy?

As of March 2, 2024, over 70 million bank customers were at risk of losing access to their accounts. Why so? The Central Bank of Nigeria (CBN) has implemented a mandatory policy requiring the linkage of National Identification Numbers (NIN) with Bank Verification Numbers (BVN) for all individual Tier 1 bank accounts and wallets.

This initiative aims to strengthen Know Your Customer (KYC) procedures, enhance financial inclusion, and combat fraud within the Nigerian banking system.

Here’s a breakdown of the policy:

- Affected Accounts: The mandate applies to all individual Tier 1 accounts and wallets. Tier 1 accounts are typically low-value accounts that can be opened with minimal or no documentation, such as a passport photograph. They have a deposit limit of N50,000 and an operating balance of N200,000. Tier 1 accounts are mostly not linked to the BVN and are targeted at the unbanked population.

- Deadlines:

- For existing accounts:

- Unfunded accounts: “Post No Debit or Credit” restrictions were placed immediately (as of December 2023).

- Funded accounts: “Post No Debit or Credit” restrictions were placed on March 1st, 2024, effectively blocking transactions.

- For new accounts: Since December 2023, no new Tier 1 accounts can be opened without BVN/NIN linkage.

- For existing accounts:

- Implications of Non-Compliance: Failure to comply with the CBN’s mandate can lead to:

- Account restrictions: Affected accounts will face limitations on transactions or complete blockage.

- Financial penalties: The CBN may impose fines on non-compliant banks. For example, In 2023, Guaranty Trust Bank was fined N128.6 million by the Central Bank for failing to meet several regulatory requirements.

- Reputational damage: Non-compliance can damage a bank’s reputation and customer trust.

By linking NIN with BVN, the CBN aims to create a more secure and transparent financial system, fostering an environment conducive to financial inclusion and economic growth.

Beyond Compliance: What to do about the CBN’s Mandatory Policy

A recent report by fintech operators highlighted a 277% increase in fraud within the first half of 2023, resulting in losses of at least ₦9.7 billion for deposit-taking institutions.

The CBN’s policy, when implemented effectively, represents a powerful opportunity for banks to combat fraud and also reap some additional benefits like:

-

- Secure customer onboarding: Multi-layered verification using both BVN and NIN is far more secure than traditional methods like passport photographs. It makes it more difficult for fraudsters to create fake accounts or impersonate legitimate users.

- Improved Risk Management: Accurate customer data allows banks to develop better risk profiles. By identifying suspicious activities based on discrepancies in BVN and NIN information, banks can take proactive measures to prevent fraud attempts before they occur.

- Reduced Operational Costs: By deterring fraud, banks can minimize losses and associated costs like chargebacks, compliance fines and refunds. This translates to increased operational efficiency and profitability.

-

- Better Customer Experience: Instant BVN/NIN verification eliminates the need for lengthy manual verification processes. Your customers also gain peace of mind knowing their accounts are better protected against fraudulent activities, increasing their satisfaction and loyalty.

A Practical Approach for Banks:

Here’s a practical approach for banks to maximize the strategic benefits of BVN/BVN linkage:

- Leverage Technology: Invest in robust BVN/NIN verification solutions that offer:

- Instant Verification: Real-time verification eliminates delays and simplifies account onboarding.

- Bulk Verification Services: Cleanse existing data proactively and identify potential errors to ensure compliance and avoid fines.

- Data Analytics: Use the enriched data obtained through BVN/NIN linkage to gain valuable insights into your customer base, including demographics, risk profiles, and financial behaviour.

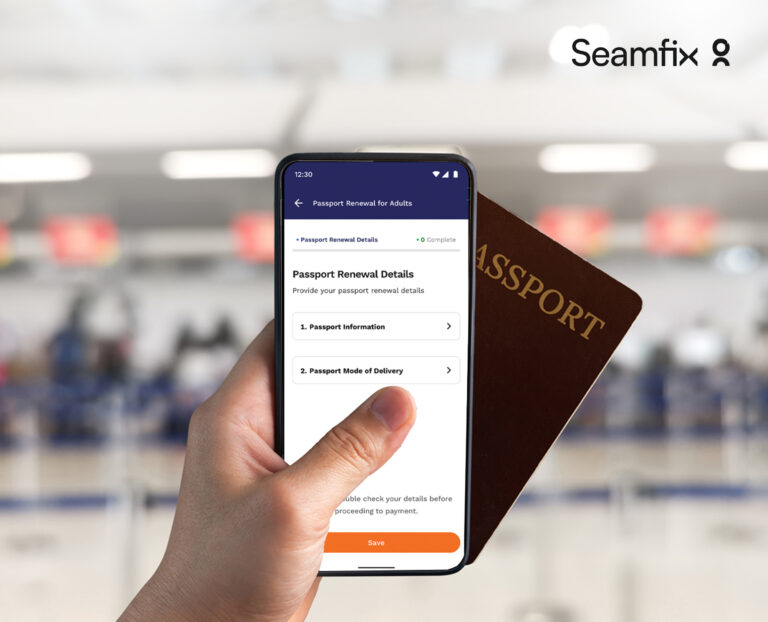

- Prioritize User Experience: Design a user-friendly BVN/NIN verification process that is:

- Simple and Intuitive: The process should be easy to understand and navigate for all customers, regardless of their tech skills.

- Mobile-Friendly: Offer mobile verification options to cater to today’s mobile-centric customer base offline and online.

- Transparent and Secure: Clearly explain how BVN/NIN data is used and ensure robust data security measures are in place.

- Build Staff Awareness: Train your staff, from front-desk officers to on-field agents, on the importance of BVN/NIN verification and its role in enhancing customer experience and reducing fraud. Empower them to answer customer questions confidently and efficiently.

- Develop Data-Driven Strategies: Use customer insights to develop targeted marketing campaigns and tailor product offerings to specific customer segments. This can increase customer engagement and revenue growth.

The CBN’s NIN/BVN policy presents a golden opportunity to streamline processes, fight fraud, and delight customers. But how do you turn this opportunity into reality?

Solutions Offered by Seamfix: Empowering Your Bank with Secure and Efficient KYC

We understand the challenges banks face in complying with the CBN’s NIN/BVN linkage mandate. At Seamfix, we offer a suite of solutions designed to make the process seamless, secure, and strategically beneficial for your bank.

Effortless Onboarding for Happy Customers:

Imagine this: a new customer walks into your branch or opens your app, ready to sign up. Or one of your agents meet a market woman who’s looking for a bank to save with. With our Self-service ID Verification Platform, verification is a breeze. They simply scan their NIN or BVN, and within seconds, their identity is confirmed. No long lines, no paperwork, just a smooth and positive first impression.

Our platform boasts several advantages:

- Mobile-First Experience: Cater to today’s on-the-go customers with mobile-friendly verification that works seamlessly on any smartphone.

- No Coding Required: Simplify implementation with our user-friendly platform. No coding expertise needed – just customize the verification flow to your needs.

- Seamless Integration: Minimize disruption with our solutions that integrate effortlessly with your existing systems in 24 hours or less.

- Globally Recognized: Go beyond Nigeria! Verify any Nigerian ID and support international clients with our comprehensive coverage in over 223 countries.

- Advanced Security: Protect your bank and your customers with our robust security features, including liveness checks, image quality assessment, and background checks. We deliver a 98% verification accuracy rate, minimizing fraud risks.

- Fast Results: Slash onboarding time by 90% with instant verification. This translates to happy customers who can access your services right away. We helped Invest Bamboo to verify over 50,000 customer NINs and reduced customer turnaround time for First Bank’s agency network by over 50%.

Cleaning Up Your Data: A Proactive Approach

Do you have a backlog of customer data that needs verification? Don’t sweat it! Our Bulk Verification Service takes care of everything. It allows you to verify large volumes of customer data simultaneously, ensuring accuracy and compliance.

Here’s how it empowers your bank:

- Clean Up Your Data: Identify and rectify errors in existing records, avoiding hefty fines from the CBN.

- Meet Compliance Deadlines: Ensure you meet deadlines for revalidation, like the April 1st deadline for BVN/NIN revalidation, and avoid account restrictions.

- Improve Risk Assessment: Minimize manual data entry errors and prevent fraud with pre-populated, verified customer information.

- Scale Safely: Our solutions can handle even the largest volumes of verification requests efficiently, allowing you to accommodate your growing customer base.

- Trusted by the Best: We are the partner of choice for leading organizations in Nigeria. Our track record speaks for itself – we cleaned over 40 million customer records for MTN Nigeria in just 10 days!

The choice is clear. By partnering with Seamfix, you gain a powerful suite of solutions that streamline compliance, enhance customer experience, and strengthen your security posture.

Contact us today to see how we can help you implement the CBN’s policy as easily as setting up a new social media account. It’s that seamless. We promise a 24 hour transition from a manual method or another vendor with no additional costs.

Taking Control: Transforming Compliance into a Competitive Edge

The CBN’s NIN/BVN linkage mandate might seem like just another hurdle. But using the right approach as we stated, it can become a catalyst for positive change. You can kickstart this by choosing the right verifcation vendor like Seamfix. Here’s why:

- Achieve Seamless Compliance: Our solutions ensure you meet all regulatory requirements and avoid potential fines.

- Streamline KYC Processes: Reduce manual workloads and free up valuable staff resources to focus on core business activities.

- Enhance Customer Onboarding: Deliver a fast, secure, and user-friendly experience for new customers.

- Strengthen Fraud Protection: Use advanced verification technologies like Biometrics, AI, and machine learning to minimize fraud risks and protect your customers.

- Gain Valuable Data Insights: Leverage accurate and verified data to develop targeted marketing campaigns and tailor products that better serve your customer base.

Seamfix empowers you to transform compliance into a strategic advantage. Don’t wait! Contact us today to schedule a free consultation and learn how our solutions can help you transform KYC into a strategic driver of growth and success for your bank.