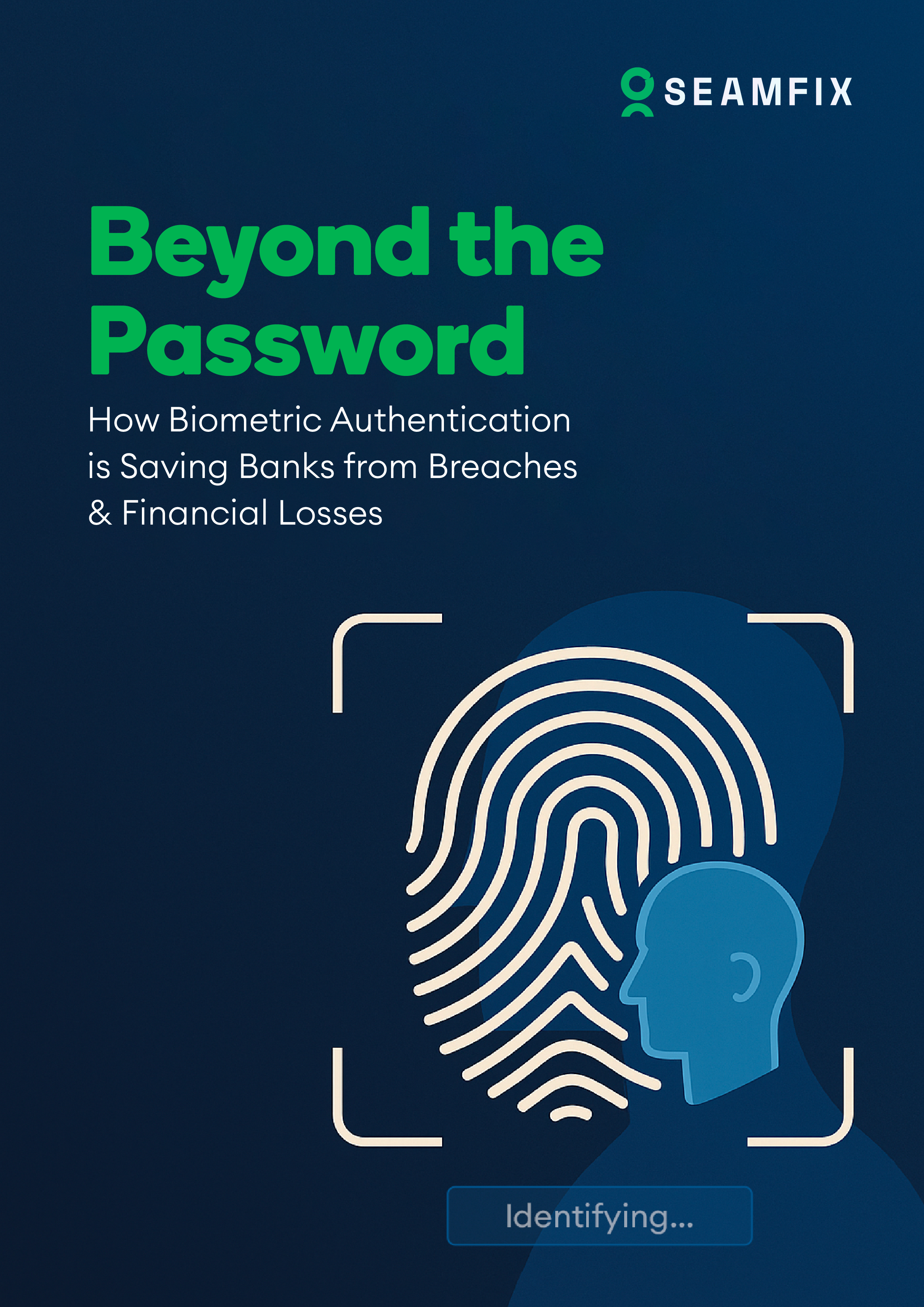

ELIMINATE BLIND SPOTS IN BANKING ACCESS WITH BIOMETRICS

The Risk of Shared Credentials in Banking and the Biometric Fix

INSIDE: Your Access Logs Might Be Lying to You.

In this free ebook, uncover how outdated authentication practices like shared passwords across systems such as core banking platforms like T24 or Finnacle, ERP, and Outlook create dangerous blind spots that make it impossible to verify who performed critical banking transactions.

Learn how biometric authentication and transaction-level authentication can close these gaps giving you airtight access control, real accountability, and full compliance with global banking standards.

Protect your institution, your customers and your reputation with identity-first security built for modern banks.

Eliminate the Blind Spot in Your Bank’s Access Control Before It Costs You

Outdated authentication practices and shared credentials are creating critical blind spots in banking systems, a hidden “Access Blind Spot” where accountability disappears, insider threats thrive and compliance hangs by a thread.

In this essential ebook, you’ll uncover how next-generation Biometric Multi-Factor Authentication (MFA 2.0) and transaction-level identity verification are helping banks like yours:

-

Replace shared passwords across core banking platforms like T24 or Finnacle, ERP, Finnacle, Outlook, and internal databases with verifiable human identity no more generic login trails.

-

Instantly verify users at every login and high-risk transaction using real-time facial and fingerprint authentication even across remote branches or agency networks.

-

Meet audit and compliance requirements with detailed, user-specific logs that regulators trust.

-

Accelerate digital transformation by enabling secure remote access without relying on perimeter-based models like VPNs.

- Reduce operational costs and help desk burdens tied to password resets, lockouts, and manual onboarding/offboarding.

You’ll also explore case studies in the banking Industry where biometric-first authentication helped eliminate credential sharing, secure millions of accounts, and boost customer trust.

These Secrets Were Used By:

Trusted By 1,000+ Businesses To Stay KYC Compliant

Here Is What You’ll Discover:

-

HHow to assess whether your current authentication setup, especially MFA, is exposing your bank to internal fraud, regulatory risk, or operational bottlenecks. Learn what modern banks are doing to upgrade fast.

-

How to close the dangerous gaps that traditional MFA leaves wide open like password sharing, generic login trails, and blind spots in systems like core banking platforms (T24, Finnacle etc.), Outlook, and Oracle ERP using biometric authentication at the transaction and access level.

-

Why app-layer biometric MFA (MFA 2.0) is a game-changer for banks. Understand the critical difference between device-layer and application-layer authentication and how it affects traceability, compliance, and user experience.

- Why your business is at risk of being a front for money laundering – you never think it’ll happen to you… until you get a scary ‘investigation’ letter from the SARB

- How a telco, university, and retail giant solved their KYC compliance failures in record time – while protecting their customers and avoiding BILLIONS worth of fines in the process

Dr. Gabriel Inya-Agha

from Quickening Integrated Services

A seamless onboarding experience made our transition and use a breeze. Seamfix Verify is super easy to use, and we’re pleased to be working with the team.

Tayo

from Interswitch

Product stability is a strong point for us, and our developer team integrated Seamfix Verify so easily that we’ve hardly ever escalated any issues since day 1

Abdulazeez

from Esusu Africa

The straightforward integration process of Seamfix Verify allowed us to verify our Merchants and agents via their digital platform swiftly. Negotiating pricing for specific verifications showcased their flexibility and commitment to meeting our needs

Folorunsho

from Eshop Africa

E-shop Africa’s strategic integration of Seamfix Verify into our shipping process effectively curbed identity fraud. We use their document Verification to ensure secure and compliant transactions, setting a new standard in reliability

Ssuna Ronald

from LipaLater

Seamfix Verify’s collaboration with tech partners and governments expedites the identity verification process globally. Their services cater perfectly to startups’ needs anywhere in the world.

Thea Sommerseth

from Diwala

Seamfix Verify enhances identity verification ecosystems by leveraging national IDs and biometrics. Their commitment to credibility and reliability is commendable.

Vanessa Cara

Veremark

Your services have exceeded our expectations and demonstrated significant value to our organization. Your dedication, responsiveness, and the quality of your solutions during the pilot phase have been exemplary. Your contributions have not only met but surpassed the requirements outlined in our initial agreement.